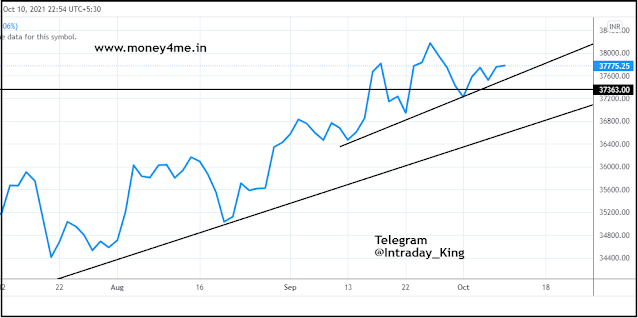

Friends, as we know, candlestick analysis is a very simple and sweet technique to predict future price action. However, we have to keep it simple. We have found one more stock chart based on a monthly time frame i.e., Glenmark Pharma. We have a good opportunity here to add this stock to the portfolio. The stock is having good strength of the more up move. The stock has given pullback with low volumes and now taking rest near the previous demand zone.

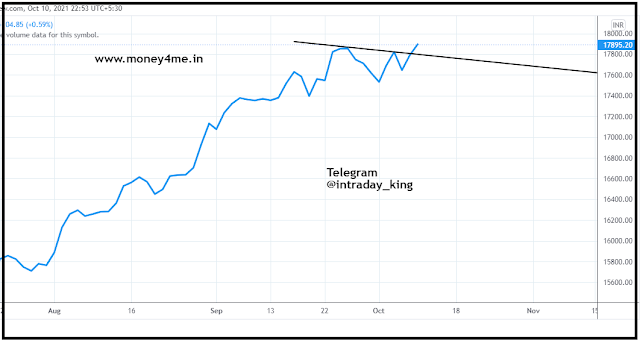

Chart Analysis of GLENMARK PHARMA: As per the monthly chart, the stock was in a downtrend from September 2015. And the trend has changed after the first lockdown. After that, the stock showed a back-to-back rally and touched 700 price levels i.e., the previous Lower High. It is trading near 500, and as per the chart, it is ready to make a second shoulder. Focus the chart from 2017 to CMP then it is making Inverted Head & Shoulder. That is the reason I am bullish on this stock from current levels with small risk. Immediate support is around 450 and resistance is 700. If it gives breakout to 700 then we can expect big targets.

The company is primarily engaged in the business of development, manufacture and marketing of pharmaceutical products.

1.

Quarterly net profits are gradually

increasing.

2.

Yearly net profits are stable.

3.

Return on equity is 14%

4.

Promoters have 46% holding.

5. FIIs maintaining their holdings above 25%, and DIIs has increased holding in last 4-5 quarters.

Telegram: https://t.me/Intraday_King

-------------------------------------------------------------------------------------------------------------

Disclaimer: The contents produced here are purely for educational purposes. They should not be construed as buy/sell recommendations. I am not a SEBI registered Analyst or Investment Advisor. Readers are advised to consult their Investment advisor before taking any decisions based on the above write-up.

-------------------------------------------------------------------------------------------------------------------------------------